How To Create A 1099 In Turbotax

Updated:

Original:

What Is a 1099 and Why Did I Get One?

I was a Registered Tax Return Preparer (RTRP) and a partner in 3 national brand tax preparation stores in Pennsylvania for over 10 years.

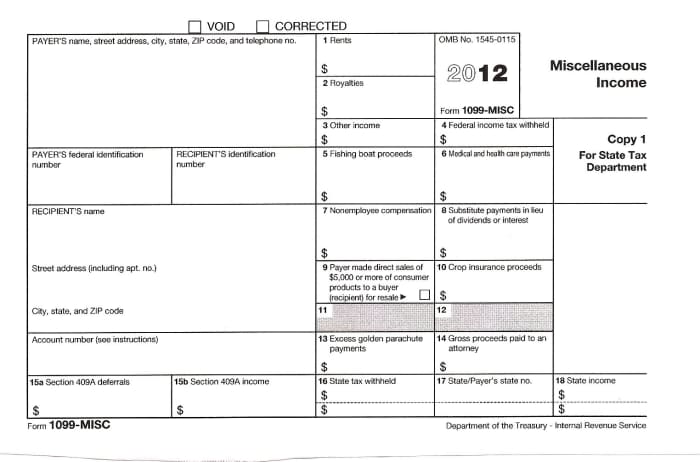

2012 1099-Misc

Bankscottage

1099s Report Income to You

In general, 1099 forms are used to report income that is potentially taxable to you. There are at least seventeen 1099 forms.

1098 forms are used to report payments that you made and that are potentially tax-deductible such as mortgage interest (1098) and college tuition (1098-T).

Unless otherwise indicated, you should receive these forms by January 31st following the tax year they pertain to. Filing your tax return prior to receiving all of your forms could require you to file an amended tax return (1040-X) after you finally receive them.

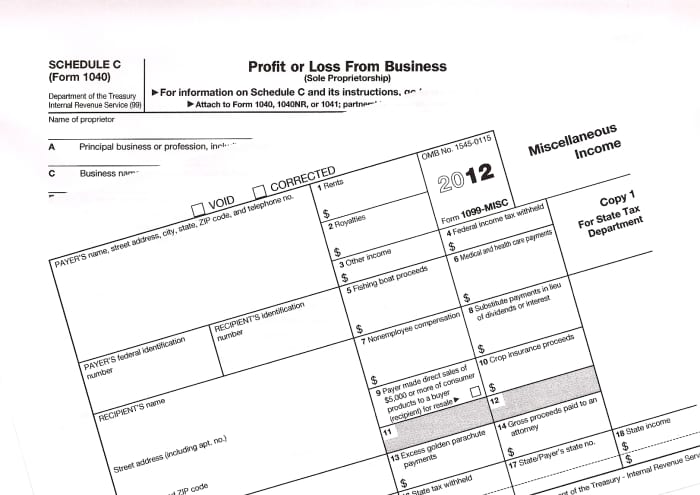

Schedule C and 1099-Misc

Bankscottage

1099 of the Self-Employed

This is the big one that, in my tax office, people are often surprised they received. They do a little work for someone, maybe babysitting, car repair, consulting or cleaning a house and at the end of the year, they get a 1099-MISC.

1099-MISC

1099-MISC forms are issued to non-employee independent contractors for services performed. No income, Social Security or Medicare taxes are deducted from this income by the payer (although back-up withholding rules do apply).

Everyone who receives $600 or more from a payer will be issued a 1099-MISC from that payer.

To report this income on your 1040, the income is first reported on Schedule C with expenses deducted from the gross income reported.

Self-employed individuals are required to pay both the employer and employee portions of the Social Security and Medicare taxes.

Taxpayers who did not expect to get a 1099-MISC and did not keep tract of expenses are surprised not only by their income tax bill, but also the Social Security and Medicare taxes they have to pay at the end of the year.

In addition to being used to report income to a sub-contractor or independent contractor, 1099-MISC is also used to report such earnings as:

- Rent or Royalty Payments ($10 or more reportable)

- Prizes and Awards, such as winnings on TV or Radio Shows (Note: Gambling winnings are reported on a W-2G).

- Payments to Crew Members by Owners or Operators of fishing boats including payments of proceeds from the sale of the catch

- Fish purchase paid in cash for resale.

- Crop insurance proceeds.

- Substitute dividends and tax-exempt interest payments reportable by brokers.

- Gross proceeds paid to attorneys ($600 and over).

Most 1099-MISC should be received by January 31st with a few exceptions due by February 15th.

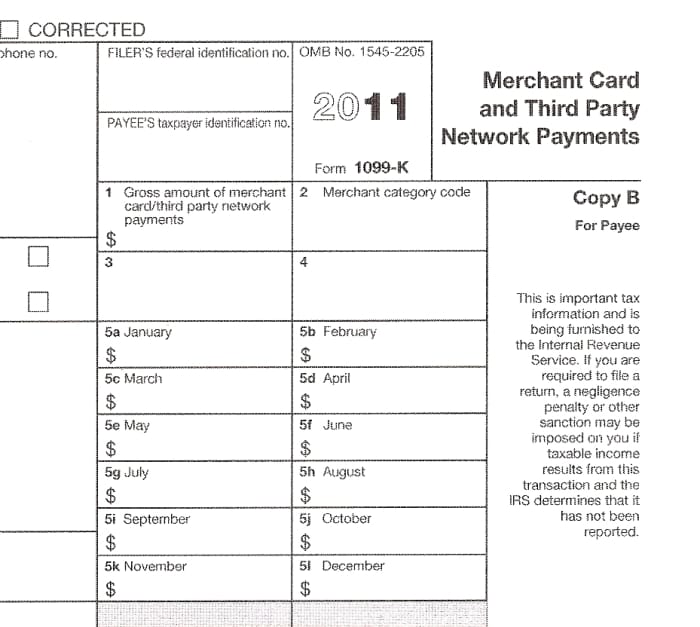

Form 1099-K

Bankscottage

1099-K

Banks and other payment settlement entities, such as PayPal, are required to report payment card and third-party network transactions with their participating merchants. 2011 was the first year this form was required to be used.

Read More From Toughnickel

Merchant Card and Third-Party Network Payments

Unlike a 1099-MISC, the 1099-K is for informational purposes. Basically, it documents the credit card or third-party network payments you receive in return for goods or services. Most likely, you will already have records documenting these transactions when they occurred. Do not double count the transaction records (gross receipts) and the 1099-K.

With the 1099-K, the IRS hopes to decrease underreporting of these types of transactions and thus underreporting of income and the subsequent income tax owed by small business owners.

If you received $600 or more as a single or aggregate payment from a third-party network or credit card company, you will receive a 1099-K by January 31st. This will affect a lot of people who run eBay or other online businesses. Since writers on HubPages are paid only through PayPal, a third-party network, writers will no longer receive a 1099-MISC from HubPages, but will instead receive a 1099-K from PayPal.

The Common 1099s

The common 1099s that many people receive include:

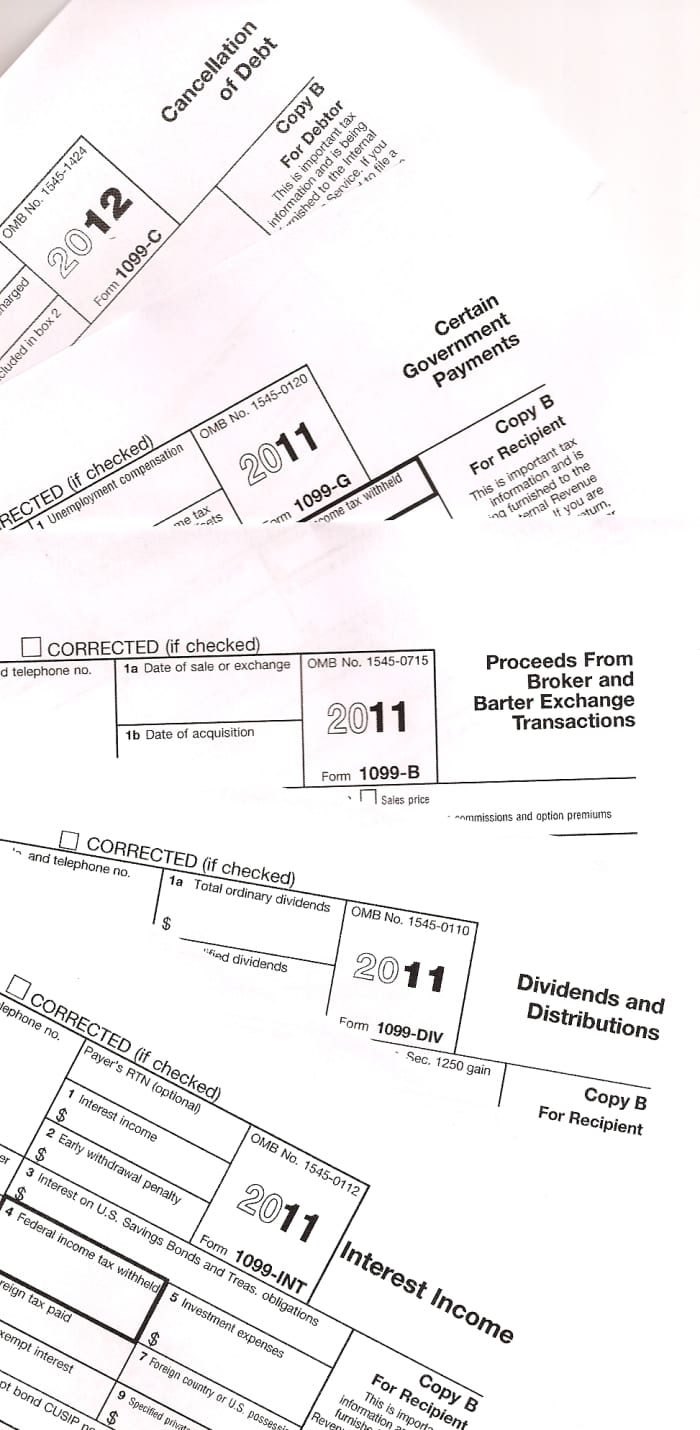

- 1099-INT Interest Income: Interest income from banks, credit unions, and other financial institutions are reported on a 1099-INT. Interest from savings bonds are also reported on a 1099-INT, but interest from money market accounts is reported on a 1099-DIV.

- 1099-DIV Dividends and Distributions: Dividends, capital gain distributions and nontaxable distributions paid on stock, mutual funds or ETFs are reported on a 1099-DIV.

- 1099-G Certain Government Payments: State and local tax refunds and unemployment compensation are reported on a 1099-G. It is also used to report agricultural payments and taxable grants.

- SSA-1099 Social Security Benefit Statement: Social Security benefits and your payment of Medicare Part B and/or Part D premiums are reported on an SSA-1099.

- 1099-R Distributions from Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.: Distributions from pensions, annuities, 401(k)s, IRAs and insurance contracts will be reported on a 1099-R. Transfers, conversions, and recharacterizations of IRAs will also be reported on a 1099-R. While all of these transactions must be reported on your income tax return, not all of them result in a tax liability.

- 1099-B Proceeds from Broker and Barter Exchange Transactions: A 1099-B issued by a broker or financial institution records sales or redemptions of securities such as stocks, bonds, mutual funds, and ETFs. It is also used to record the sales or redemptions of futures transactions, commodities, and barter exchange transactions. It must document the date of purchase and the purchase price (basis) as well as the date of sale and sales price of each asset sold or redeemed. You should receive this form by February 15th.

- 1099-C Cancellation of Debt: You will receive a 1099-C with the cancellation of debt by a financial institution, a credit union, the Federal Government, the U.S. postal service, FDIC or NCUA. Unless your debt is canceled as a result of bankruptcy or you document that you are insolvent at the time the debt is canceled, the canceled debt will be considered taxable income. Under the Mortgage Debt Relief Act of 2007, the forgiveness of debt by restructuring or foreclosure on your principal residence is generally not taxable. This act expires at the end of 2012. Taxpayers who have a credit card debt canceled by a bank are surprised to receive a 1099-C and even more surprised as to how it affects their taxable income. Often, instead of receiving a refund they now owe taxes.

- 1099-OID Original Issue Discount: OID is a type of interest on zero-coupon bonds and other similar debt instruments that pay no interest until their maturity.

- 1099-S Proceeds from Real Estate Transactions: Gross proceeds from the sale of real estate and certain royalty payments are reported on a 1099-S.

1099-G, -C, -B, -DIV, and -INT

Bankscottage

Other Less Common 1099s

- 1099-A Acquisition or Abandonment of Secured Property

- 1099-CAP Changes in Corporate Control and Capital Structure

- 1099-H Health Coverage Tax Credit (HCTC) Advance Payments

- 1099-LTC Long-Term Care and Accelerated Death Benefits

- 1099-PATR Taxable Distributions Received from Cooperatives

- 1099-SA Proceeds from an HSA, Archer MSA, or Medicare Advantage MSA

Caution!

Any federal tax or tax planning information provided above or linked to this article is not meant to be specific to any particular individual or situation. Anyone who wishes to apply this information should first discuss it with an accountant or tax professional to determine its appropriateness or how it specifically applies to their unique situation.

This article is accurate and true to the best of the author's knowledge. Content is for informational or entertainment purposes only and does not substitute for personal counsel or professional advice in business, financial, legal, or technical matters.

© 2012 Mark Shulkosky

Related Articles

How To Create A 1099 In Turbotax

Source: https://toughnickel.com/personal-finance/What-is-a-1099-and-Why-did-I-Get-One

Posted by: shustermuder1970.blogspot.com

0 Response to "How To Create A 1099 In Turbotax"

Post a Comment